Project selection is key to creating a high-quality menu of opportunities from which to diversify your exposure.

With thousands of projects being produced annually, it's difficult to predict if any one project will have just the right mix of factors (and luck) to capture the public imagination and produce outsized returns. The key is to select projects that have the right structural attributes that position them for success and to eliminate those which do not. Then diversify sufficiently to mitigate downside risk and capture the upside of some top performers.

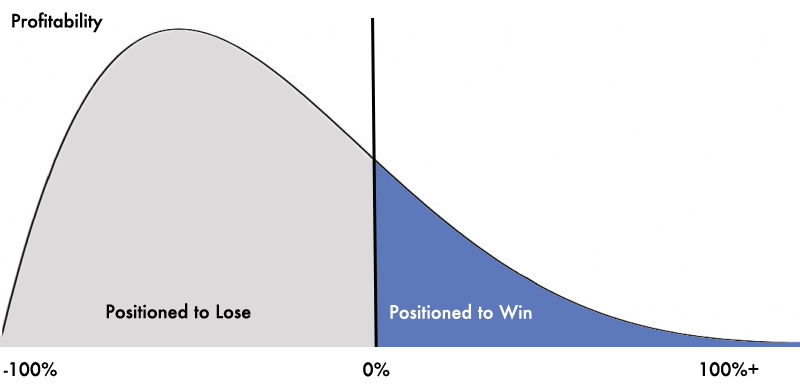

For illustration purposes only. The figure above does not represent actual profitability data.

In aggregate, the distribution of returns in the entertainment industry is right-skewed. A large number of projects lose most or all of their investment and a smaller number of projects reach profitability, with a subset of those producing outsized returns. While it's very difficult to predict the magnitude of any given project's success, projects that do succeed tend to share common attributes that can be identified in advance.

Some of Creatis' project criteria include:

Creative

- High-quality script or project idea vetted by industry expert partners

- Core creative team with strong track records in the genre and budget range

Commercial

- Recognizable creative & acting talent attached or with letter-of-intent (LOI) in place

- Cost-controlled productions that dedicate an appropriate portion of capital to securing talent that has proven marketability and audience draw

- Pre-identified target audience & market strategy

- Reasonable territory sales estimates by reputable sales agents

- Strong preference for projects with a major distributor attached

Financial

- Intelligent “soft money” strategy – e.g. territory production tax credits, gov’t film funds, crowdfunding or grants – to cover a meaningful share of the production budget

- Pre-sold rights agreements (such as foreign pre-sales) to reduce risk and use as collateral for obtaining financing

- Contracts and agreements must conform to industry best-practices and market standard terms to protect against creative accounting practices that can erase returns to investors

- Preference for co-financing partners in place

- Preference for completion bondable productions

Structural

- Each project must pass Creatis’ financial and regulatory due diligence process

- Standard background and reputational checks of creative principals & partners